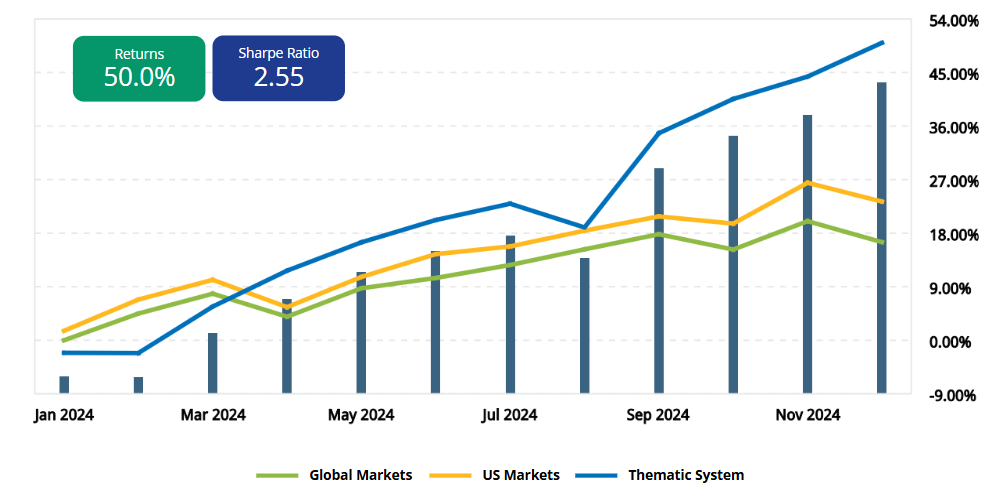

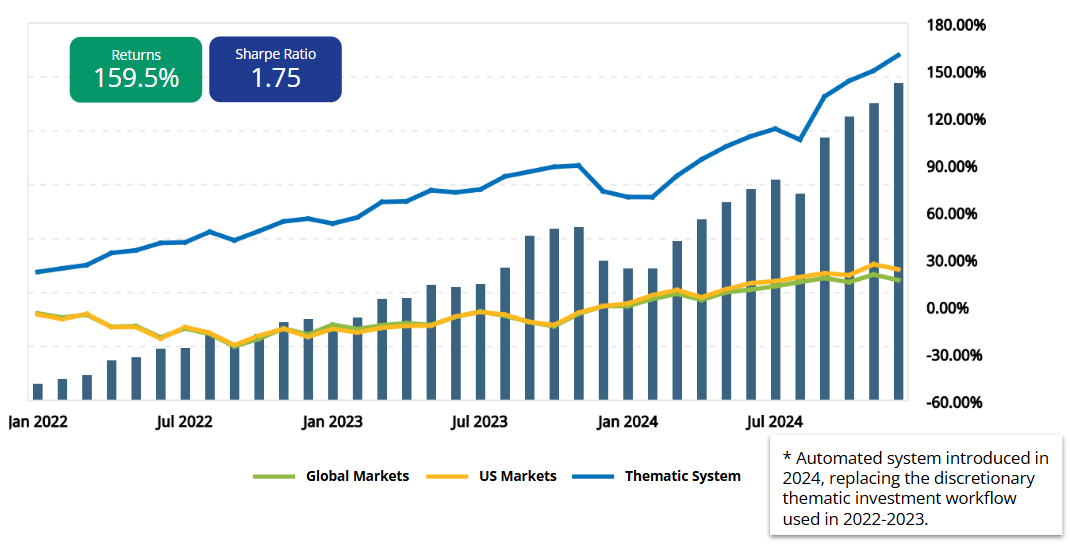

Consistent High Returns - Outperforming 99% of Hedge Funds

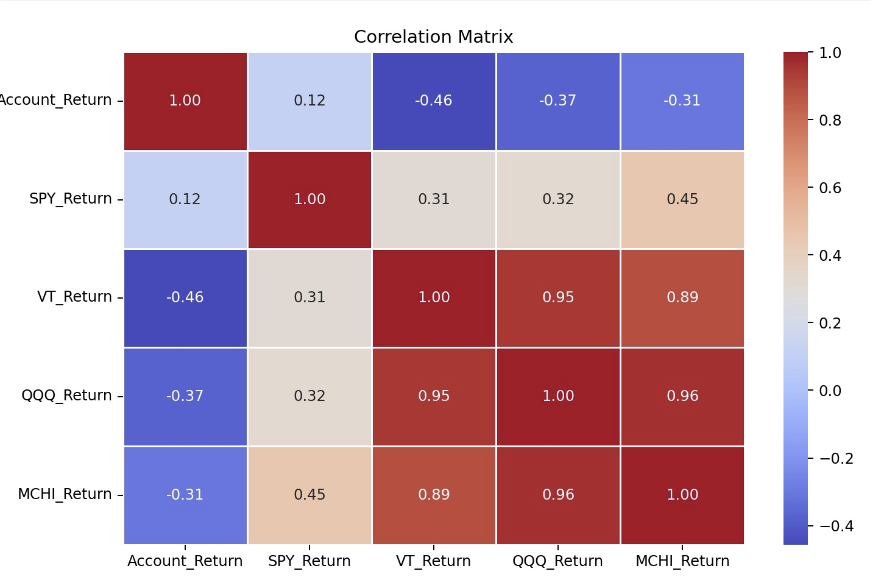

Low Risk - Superior Risk Adjusted Performance

Smarter Diversification with Global Multi-Assets Exposure

Our Systems

AI-Enhanced Data Insights

Leverages large language models (LLMs) to analyze research reports and financial news, uncovering actionable themes.

Combining News & Price Analysis

Tracks price and volume changes, ETF flows, and news traction using advanced quantitative techniques.

Active Monitoring

Continuously tracks price, volume, and market interest for optimal timing and decisions.

Effective Trade Expression

Structuring trades based on conviction and market regime for enhanced risk adjusted returns.

Portfolio Analyst Agent

The Portfolio Analyst Agent is an AI-driven system that proactively manages risk by analyzing real-time news, technical signals, and market events.

Ticker Research Agent

Making use of both internal and real time data sources, the Ticker Research Agent analyzes fundamentals, news, and competitors while uncovering key quantitative patterns to support informed investment decisions.

Easy Integration

Our Agents leverage the LangGraph orchestration framework and communicate via the Model Context Protocol (MCP), providing standardized, plug‑and‑play integration into any portfolio or trading system for truly effortless deployment.

More information coming Soon

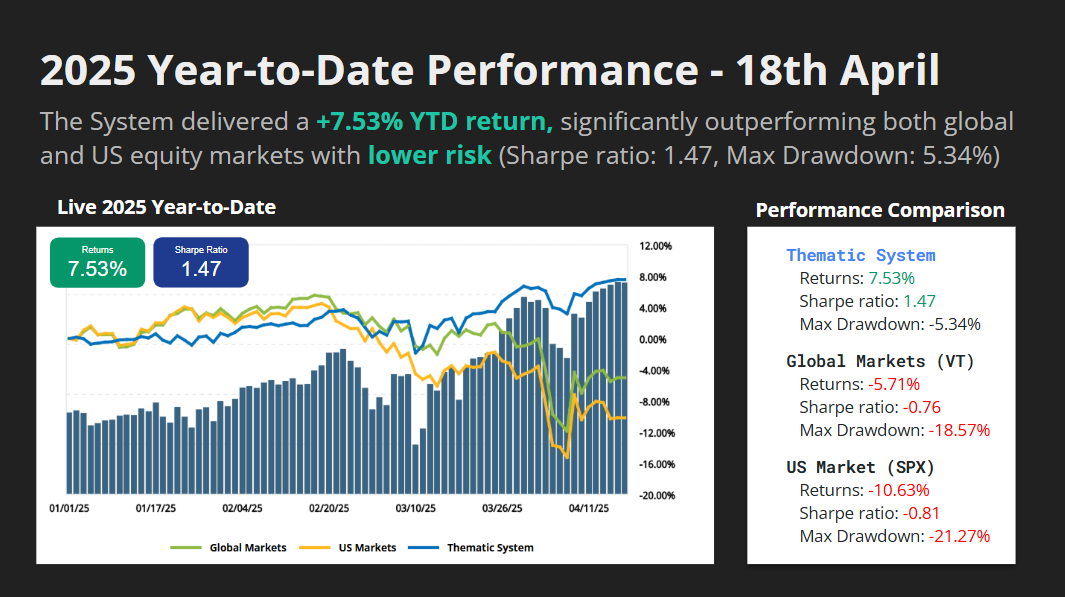

Our Performance

What to expect

Family Offices

Integrate our investment portfolios and advanced data-driven insights—powered by AI agents that discover emerging themes, identify high-conviction tickers, and monitor market signals—with your firm’s existing strategies for enhanced returns and smarter diversification.

Individual

Learn how our systems make it easy to access professional-grade investment strategies, offering clear, data-backed insights to support your financial goals.

Expansion and Partnership Opportunities

We are excited to expand our trading operations to Singapore, Indonesia and Malaysia. We are actively seeking local partners to collaborate on the following:

- Quality investment news sources

- API access for automated execution

- Prime broker service

- Fund launch